Forty start-ups and scale-ups pitched their solutions for a more sustainable industry, but the discussions among experts on stage focused on how to prevent all these promising innovations from failing before they even have a chance to grow.

The joint conclusion was sobering and urgent: the technology is there, as is the entrepreneurship, but the European ecosystem stalls at precisely the moment when things get exciting – the scaling up from lab to demo, and from demo to large-scale production.

The challenge is growing

Dirk Carrez, Executive Director of the Bio-based Industries Consortium (BIC), co-organiser of this event, opened the day with a sharp outline of that paradox. Whereas BIC started twelve years ago with a handful of companies, the network now has almost 400 members, 80 per cent of which are SMEs.

This growth shows that there is plenty of innovation in the biobased sectors, but according to Carrez, this is just the beginning. The bioeconomy will only flourish if the entire value chain moves with it: from raw materials through technology to applications. ‘If you really want to stimulate the bio-economy, you have to set up value chains from feedstock supply towards new applications,’ he emphasised. To achieve this, it is crucial that not only research but also production is anchored in Europe. BIC is making great strides in this area, including through its joint venture with the European Commission, the Circular Bio-based Europe Joint Undertaking (CBE JU).

Carrez pointed out that companies need to find each other more easily, that regulation is often too slow and that access to raw materials is insufficiently guaranteed. ‘If you want to invest in Europe, you need a critical framework,’ he warned. The message was clear: Europe needs policies that are as innovative as its entrepreneurs.

R&D phase is over

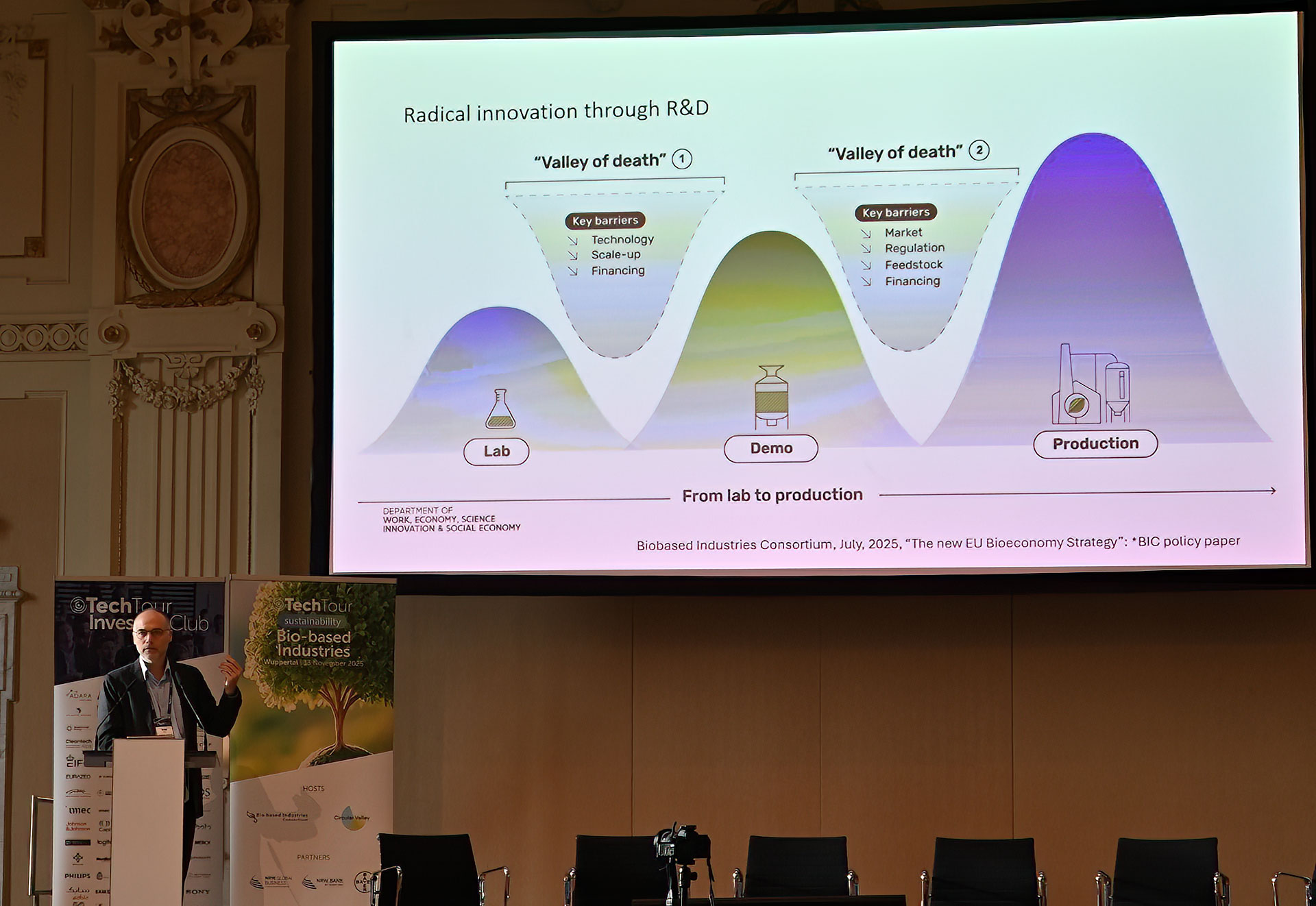

That analysis was further refined by Dries Maes, bio-economy policy advisor to the Flemish government. According to him, Europe has reached the point where research and development have done their job – now the sector must prove that it can grow. ‘The era of R&D is bearing fruit,’ he said, ‘and now it’s time to scale up all these investments.’

However, Europe is facing two “valleys of death”: one from lab to demo, and an even more dangerous one from demo to commercial production. ‘We are now talking about a second valley of death… going from present levels to actual investments for production.’

Regulation is a greater obstacle than is often assumed. Permits take too long, definitions clash and policy is fragmented, Maes noted. He also made a striking observation: banks often do not understand the sector well enough to provide financing. ‘Regular banks have very little idea about what is really going on… it’s an unknown field.’

His closing advice sounded like a warning: ‘We have to reach out beyond our sector if we want the scaling up to work.’

Candid panel discussion

The call for scaling up was the prelude to a panel discussion in which investors and fund managers addressed the financial reality behind scaling up. Panel leader Dirk Carrez pointed to a recent EIB study showing that Europe is missing €500-700 million annually to get technology from lab to demo, and even €2 to 2.5 billion to bring demonstration projects to commercial production. ‘This is huge,’ said Carrez. ‘There is a willingness to invest, but it is very difficult for companies to receive the support, the loan, the funding.’

The panellists spoke candidly about the barriers they see every day. Marcus Remmers (Novo Holdings) succinctly summed up the administrative red tape: ‘It feels like writing five PhD theses… let’s do it with twice the speed and a third of the paperwork.’

Pieter van Gelderen (Icos Capital) pointed to the lack of truly distinctive technology: ‘We need technology that is really disruptive… it’s searching for those golden stars.’

Wouter van der Putten (Capricorn Partners) argued that the venture capital logic, in which investments must yield substantial profits quickly, is poorly suited to biobased production, which has high capital costs and long lead times. “Exit valuations do not really fit into the current VC matrix.”

Jowita Sewerska (ECBF) added that many companies remain too technology-driven. “We cannot have any more technology push. We need to develop market goals.”

And according to Katrien Swerts (Rabo Investments), companies are stuck between bank criteria and market conditions: “Scaling requires all the pieces of the puzzle to come together.” Without purchase contracts, there is no bank financing, but without a factory, there are no purchase contracts – a vicious circle that many recognise.

From analysis to solutions

However, the tone also shifted to a constructive one. The panel saw numerous ways to make scaling up possible. For example, there was a clear call to encourage pension funds and banks to move a small portion of their assets towards risky, biobased projects. According to Swerts, this would create enormous leverage without posing any major risks to those institutions.

Sewerska argued for faster market validation: start-ups should be able to test products in real environments earlier on, in order to confirm or adjust market fits more quickly.

Van Gelderen called on companies to work more capital-efficiently by using existing industrial installations instead of building their own facilities. ‘Use as little capital as possible… use idle industrial capacity.’

Meanwhile, the range of European financing options is growing. Remmers pointed to the new Scaleup Europe Fund of multiple billions of euro’s, which specifically targets the second “valley of death” – precisely the leap where many companies currently fail.

The optimism at the end of the panel discussion stemmed from the growing number of companies that are breaking through despite these barriers. ‘There are some good companies and good successes in the making,’ said Van Gelderen, ‘and those examples will be very important for the rest of the sector.’

Carrez concluded by announcing that all the insights from the session will be incorporated into a joint action plan by BIC, the European Commission and the EIB. ‘The next step is action,’ he said. It sounded like both a promise and a warning.

The step towards real production

Tech Tour Biobased Industries 2025 revealed a sector that is technologically mature, but still insufficiently facilitated institutionally. Europe has the knowledge, talent and innovative power to make the biobased industry big. What is lacking is speed, clarity and a financing system that suits factories rather than apps.

The question is no longer whether biobased technology works. The question is whether Europe has the courage to take the step towards real production. The time to scale up is not tomorrow, but today.

This article was produced in collaboration with the Bio-Based Industries Consortium (BIC).